|

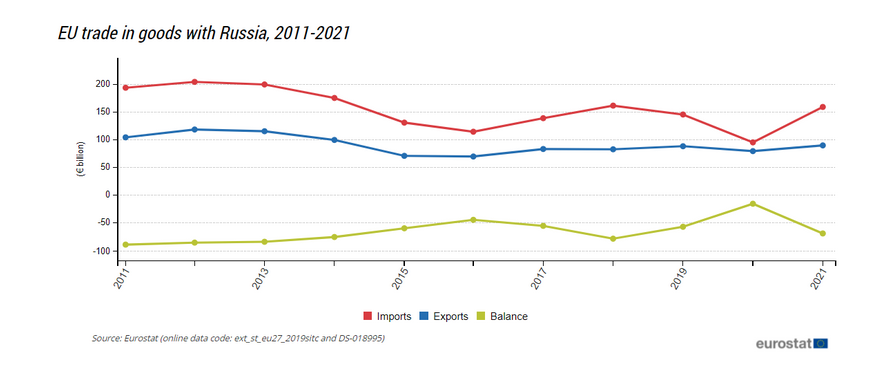

Russia is the largest exporter of oil to global markets, and the second largest crude oil exporter, behind Saudi Arabia. On the other hand, the European Union is the biggest investor of Russian Oil, buying on average 2.2 million barrels of crude oil, in addition to another 1.2 million barrels of refined products. The Ukraine crisis and the upcoming winter has raised major concerns on the issue of European Union dependence on Russian oil. How Much Does the EU Rely on Russia for oil? In the past years, the EU has been immensely reliant on Russian oil. In 2021 alone, the EU imported $108 billion (€99bn) worth of energy. Although the volume of energy the EU has been importing from Russia has fallen significantly in the past decade ($173 bn in 2012), Europe still relies tremendously on the world’s largest country, as over a quarter of the EU’s imported crude oil comes from Russia. Impact of COVID-19 Following the 2020 pandemic of the new coronavirus, the trading relationship between the EU and Russia was significantly impacted, with the EU’s trade deficit falling to $17.6 billion (€16bn), the lowest level over the past decade. Despite the pandemic immensely affecting the EU’s imports of Russian oil, the trade deficit had risen again to $75.6 billion (€69bn) in 2021. Nonetheless, the figure was still down from the 2011 amount of $97.7 billion (€89bn). insu The Impact of the Ukraine Invasion On February 24, 2022, the Russian president Vladmir Putin ordered the Russian army to a full scale invasion of the Ukrainian territory, resulting in thousands of civilians lost, and tens of thousands of injuries. The US, EU, UK, and many other countries and organisations almost instantly announced that they impose huge sanctions on the Russian government and economy. These powerful organisations and countries decided to cut their reliance on Russian oil and gas by ⅔ by the end of 2022. Furthermore, the EU has planned to become completely independent of Russian fossil fuels by 2030. After more than 30 countries imposed sanctions against Russia, the effects were shown; over 1000 foreign companies halted operations in Russia, imports to Russia declined more than 50% just this year, consumer spending has descended rapidly, and Putin is running a budget deficit, therefore, the sanctions have proved to be extremely efficient. The Issue of the EU’s Reliance Although the sanctions caused incredible damage to Russia’s economy, the consequences came back to the US, UK and especially the EU. For starters, Europe has already witnessed skyrocketing oil and gas prices since Russia invaded Ukraine, specifically Italy, as it was the second largest import of Russian energy sources in the EU, with imports making up 40% of its total supply. Furthermore, under a new Italian government decree, buildings will have to face an extra 15 days without central heating, and according to BBC: “Italians will also be told to turn their heating down by one degree, and off for an extra hour.” Italy's total imported sources of energy from Russia have now gone down to just 10%, with bills soaring and many citizens upset. Such social discontent is expected to only worsen as a result of temperatures decreasing. Consequently, Rome will have to turn to other sources of natural energy to prevent an energy crisis in future. The Solution Commission president Usula von der Leyen stated: “We must become independent from Russian oil, coal, and gas… We need to act now to mitigate the impact of rising energy prices, diversify our gas supply for next winter and accelerate the clean energy transition.” Therefore, instead of lifting Russia's sanctions and spending an estimated €60 billion on Russian energy, the EU can consider investing on sustainable green energy sources instead. - Paolo Buquicchio Bibliography

0 Comments

Leave a Reply. |

RSS Feed

RSS Feed